Attempt to answer this mysterious question concerning the Bitcoin supply limit to 21 Million units.

For many people, Bitcoin is simply the new fashionable way to get rich fast. These people are taking a shortcut, which may well play tricks on them in the future.

In life, there are no shortcuts. There is no quick fix for getting rich fast. Everything is the product of hard work and perseverance.

Bitcoin is all about power. Bitcoin is the best savings technology in the world. You place the fruits of your hard work within the Bitcoin network, and it will be protected from the ravages of monetary inflation in a way that is resistant to censorship.

This is currently Bitcoin’s greatest value proposition. As the adoption of Bitcoin by the general public progresses, you will be able to use it as a means of payment in everyday life. However, we are not there yet. That is why I repeat that we are still at the beginning of the Bitcoin revolution.

I have been writing daily about Bitcoin for several years now, sharing my ideas, opinions, and some knowledge.

The most rewarding thing is then to be able to have exchanges with newcomers in this world. It is always interesting to listen to what drives these people to come to the world of Bitcoin. Even better, I listen carefully to the questions they may have and try to provide them with answers as best I can.

One question I am often asked is this:

Why Did Satoshi Nakamoto Limit Bitcoin’s Supply to 21 Million?

This is an extremely recent question to which few people generally provide answers.

This question can be divided into two parts. The first is why Satoshi Nakamoto has limited the supply of Bitcoin. The second is why did he choose the figure of up to 21 million BTC?

Why is Bitcoin supply hard-capped?

I will start by answering the first question, which seems to be the most obvious.

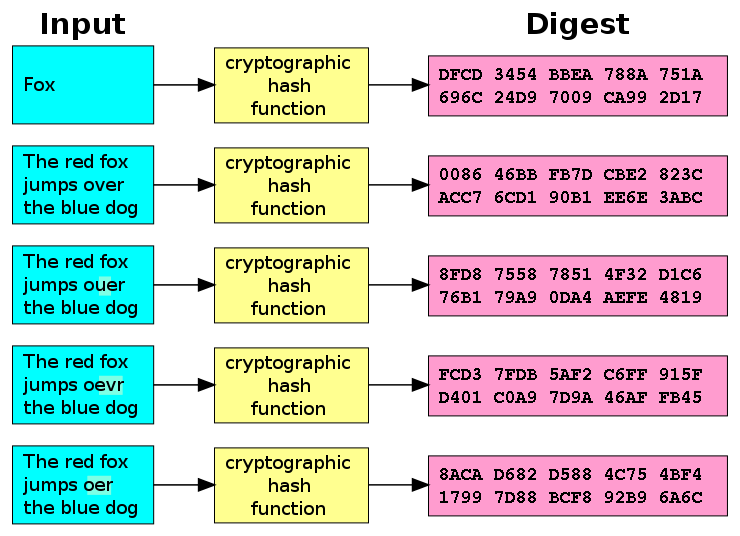

Satoshi Nakamoto understood that the problem with the current system is the total freedom given to central banks to print as much fiat money out of thin air as they deem necessary.

Thus, a few central bankers have far too much power over all the inhabitants of the earth. We should be able to trust them blindly, but history has shown us that this is impossible, as Satoshi Nakamoto rightly pointed out:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

You understand here that Satoshi Nakamoto created Bitcoin to address the problem of trust in the current banking system. Bitcoin is a successful attempt to return power to the people regarding money.

The fact that Bitcoin supply is hard-capped has ultra-positive implications for its users

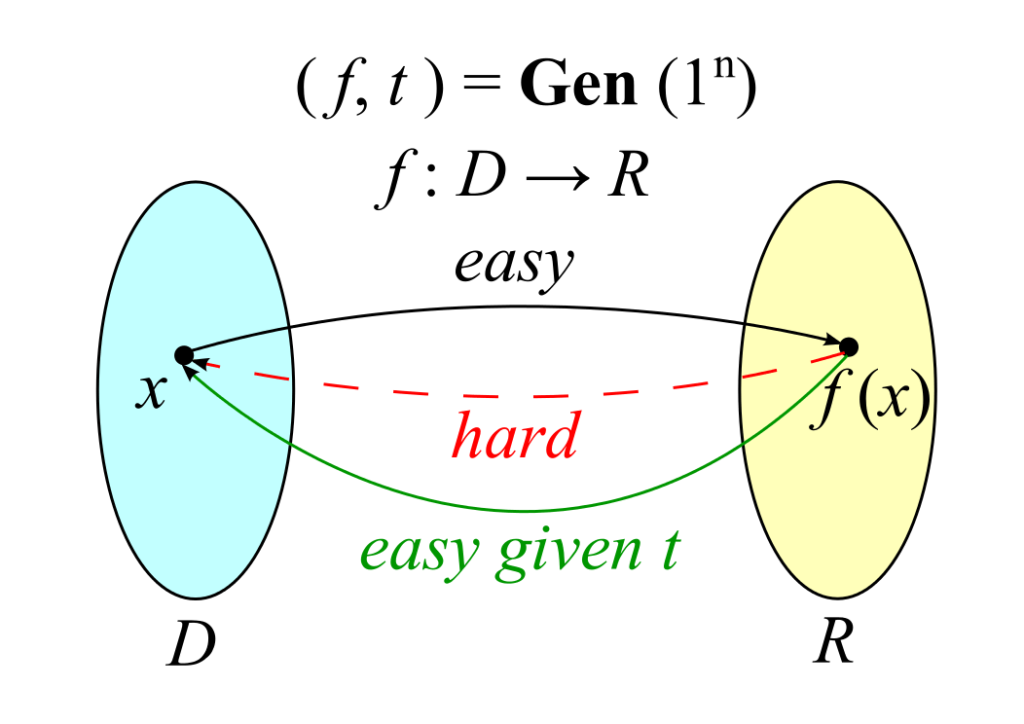

To address the problem of the endless debasement of fiat currencies in the current system, Satoshi Nakamoto has therefore limited the maximum supply of BTC that could be issued.

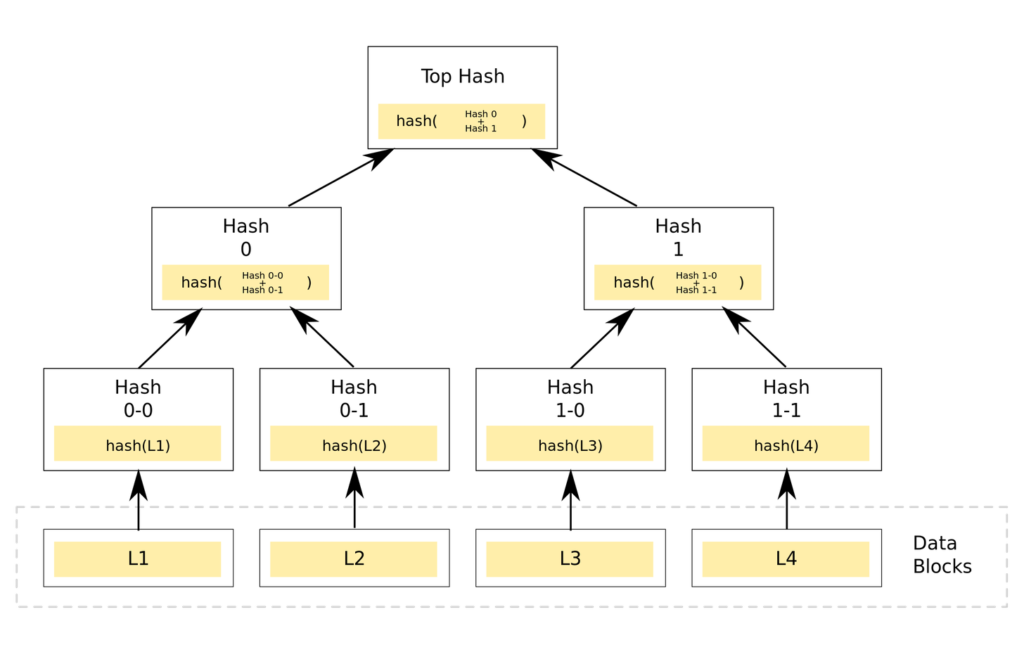

This limitation was defined within the Bitcoin source code. All nodes running on the network guarantee this essential rule.

This has incredible implications for the fruit of your labor that you secure within the Bitcoin network. If you buy 1 BTC today, you are guaranteed to still own 1 BTC out of 21 million in 10, 20, or 50 years.

With all other fiat currencies, you cannot have this essential guarantee.

Why did Satoshi Nakamoto choose the number 21 million BTC?

The second question was why Satoshi Nakamoto chose the 21 million BTC limit. Indeed, he could have chosen 20 million or 26 million after all.

To begin with, it is interesting to look back at some of Satoshi Nakamoto’s messages on this question:

“I wanted to pick something that would make prices similar to existing currencies, but without knowing the future, that’s very hard. I ended up picking something in the middle.”

Satoshi Nakamoto then added in an email exchange with the developer Mike Hearn this:

“If Bitcoin remains a small niche, it’ll be worth less per unit than existing currencies. If you imagine it being used for some fraction of world commerce, then there’s only going to be 21 million coins for the whole world, so it would be worth much more per unit.”

Satoshi Nakamoto could therefore have chosen this number of 21 million to foresee a possible alignment with fiat currencies. Thus, 0.001 BTC (1 mBTC) could have been worth $1 at term. This prediction became true in 2013. Today, 0.001 BTC is worth much more than that.

A philosophical explanation is put forward by some

Another hypothesis is related to the global money supply at the time Satoshi Nakamoto created Bitcoin. At that time, the global money supply was $21T. Known as the M1 Money Supply, this number includes the total value of all physical money in the world, including cash, coins, and travelers’ checks.

If we imagine that Bitcoin could one day become the world’s reserve currency, the figure of 21 million units for Bitcoin would have the following equivalence: 1 BTC = $1 million. The Satoshi, the smallest unit of Bitcoin, would then have represented $0.01.

All this, however, remains only conjecture.

In terms of conjectures, other people have imagined a mathematical explanation for this choice. To do so, they have assembled the various parameters of Bitcoin’s programmatic monetary policy.

Others prefer the mathematical logic behind the figure of 21 million

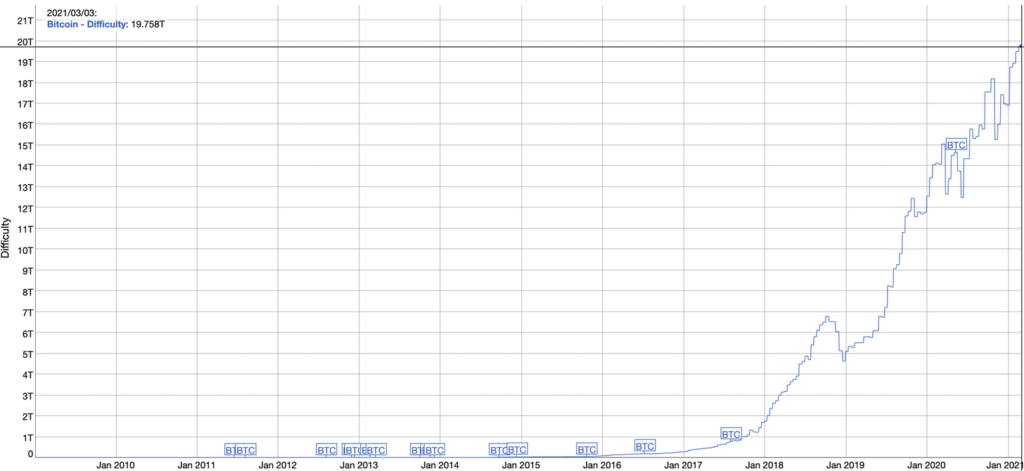

The Bitcoin core software adjusts the difficulty to mine a new block every 10 minutes on average. From this average, 210,000 blocks should be mined during each 4-year cycle. At the end of a cycle, a Halving takes place reducing by half the reward allocated to miners mining a block of transactions correctly.

In the first cycle, the reward was 50 BTC. It was halved to 25 BTC per block mined in 2012. It then dropped to 12.5 BTC in 2016, before dropping to 6.25 BTC after the Halving of May 2020.

By extrapolating this reduction, you will notice that the sum of the block rewards over each 4-year cycle is equal to 100:

50 + 25 + 12.5 + 6.5 + 3.125 + 1.5625 + … = 100

Multiplying this number by the number of blocks mined in each cycle, 210,000, you get the maximum number of BTC that can be put into circulation: 21 million. The Bitcoin supply is 21 million units no matter what.

Final Thoughts

It’s easy for everyone to understand why Bitcoin supply is hard-capped. Satoshi Nakamoto made this choice to make Bitcoin hard money. However, it is harder to know why he chose the figure of up to 21 million BTC.

Some are looking for a philosophical explanation, while others are satisfied with an explanation based on a mathematical model. I will leave you to make your own opinion based on the elements I have just revealed to you.

Indeed, the only person who can know the truth is Satoshi Nakamoto. A mysterious character if ever there was one, Satoshi Nakamoto has decided to never unveil the meaning of the figure of 21 million as well.

Wanting more insights on Bitcoin? Join In Bitcoin We Trust Newsletter.