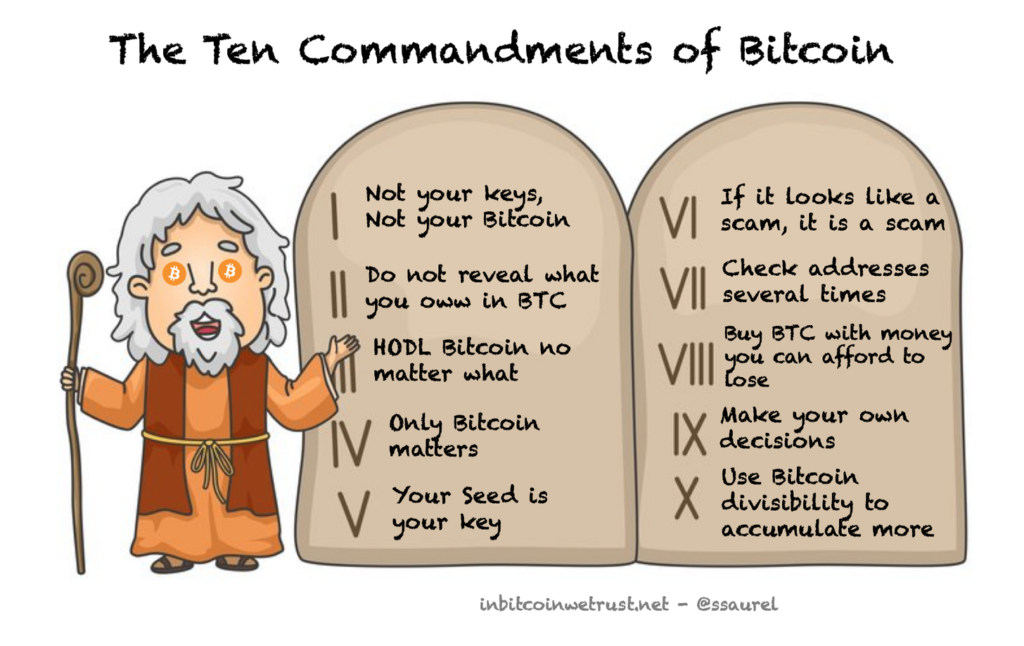

Follow the Ten Commandments of Bitcoin to the letter to take full advantage of the Bitcoin revolution.

The Bitcoin revolution will succeed. It is inevitable. Bitcoin has been progressing since its creation, following the path that all revolutions that end up triumphing take.

Remember that famous quote frequently attributed to Mahatma Gandhi:

“First they ignore you, then they laugh at you, then they fight you, then you win.”

In reality, it is an apocryphal quote. This means that it is wrongly attributed to Gandhi. The latter took this quote from a speech in 1914 by the union leader Nicholas Klein.

In any case, you understand well what this quote means.

Revolutions are always ignored at their beginning. This was the case with Bitcoin when it was officially launched on January 3, 2009, by Satoshi Nakamoto in complete anonymity. In the early 2010s, Bitcoin began to make a name for itself.

Nevertheless, the powerful people at the head of the current monetary and financial system looked at it with disdain and mocked Bitcoin. For them, Bitcoin was nothing more than the amusement of a few geeks.

When Bitcoin price surpassed $1,000 for the first time in 2013, Bitcoin began to make these politicians, central bankers, and other economists laugh less. The battle against Bitcoin became even more intense during the Bull Run at the end of 2017 when its price quadrupled in a few weeks to almost $20K.

A speculative bubble was created around Bitcoin price. Its explosion was inevitable. It caused a bear market that lasted throughout 2018 and plunged the Bitcoin price just above $3K. Many of Bitcoin’s opponents took the opportunity to announce once again the impending death of Bitcoin.

As always, Bitcoin rose even stronger. At the end of the first quarter of 2019, the Bitcoin price started to rise again, approaching $14K at the end of June 2019. Despite this, the opponents continued to resist by fighting Bitcoin.

The year 2020 was marked by a pandemic of a magnitude not seen in decades. The economic crisis that was triggered by this pandemic was so sudden that a liquidity crisis followed in March 2020. All liquid markets around the world were heavily impacted.

As the only truly free market in the world, Bitcoin was necessarily more impacted than the others. In a few hours, its price dropped by more than 50% from $8K to less than $4K.

This was the moment of glory for the opponents of Bitcoin, but also for the Bitcoiners who were able to accumulate even more BTC. The Bitcoiners knew that the Bitcoin price was bound to rebound afterward with the third Bitcoin Halving approaching. That’s what happened.

As expected, the Bitcoin price rebounded. The rebound has been incredibly strong as Bitcoin price has risen +400% since March 2020 to allow Bitcoin to beat its All-Time High just below $20K on December 1, 2020.

Throughout this rise in Bitcoin price, a growing number of major players have changed their mindset about Bitcoin. Many have realized that there is no point in fighting the Bitcoin revolution. Its success would be inevitable. Bitcoin is currently the best hedge against monetary inflation.

This has motivated institutional investors, great companies, and even PayPal to come to this world.

They all want to take advantage of the Bitcoin revolution. They need Bitcoin more than ever. Faced with such a monetary revolution, those who choose to stay along the path always end up being overwhelmed. This is what history has always taught us.

If the Bull Run we have just experienced since October 2020 were supported by smart money, retail investors will soon be flocking to the Bitcoin world throughout 2021. Indeed, the Bitcoin price is promised to rise sharply. I see the Bitcoin price able to reach $100K at the end of 2021.

The arrival of many retail investors in the coming months seems to me to be the right time to remind the Ten Commandments of Bitcoin. For those already present in the Bitcoin world, it will also be an opportunity for a reminder that is never superfluous.

I. Not your Keys, Not Your Bitcoin

Bitcoin is P2P money. When you see written that someone has Bitcoin, it is an abuse of language. In reality, that person owns a portion of the Bitcoin Blockchain.

To access this portion of the Bitcoin Blockchain, this person must have the associated private key. Without this private key, you will not be able to use that portion containing a certain amount of BTC.

When you decide to purchase Bitcoin, you must understand that the most important thing is to have the associated private keys in your possession. Without this, you will not be in complete control.

Therefore, third-party platforms such as PayPal that allow you to buy Bitcoin lock you into the same risks as with the current monetary and financial system.

Those who purchase Bitcoin via PayPal do not have the private keys associated with their BTC. They can therefore be banned by PayPal at any time, and this has already happened to one user at the end of November 2020. PayPal may also decide to censor some of your transactions for arbitrary reasons.

Bitcoin aims to give you back the power regarding money. Without your private keys, you will not be able to regain that power. Some people say that the only thing that interests them about Bitcoin is the fact that it is the best hedge against monetary inflation.

This is what we hear from most institutional investors. As an individual, you would be making a mistake if you reasoned that way. If you buy Bitcoin, choose to enter completely into its revolution. To do so, you must have the private keys to your Bitcoins. Period.

II. Do not reveal what you own in BTC

Some people love to tell everyone how much money they make. They even go so far as to reveal all the details of what they have in their bank account.

People who flaunt their wealth in front of everyone justify themselves by saying that they have nothing to hide because they earn that money by working hard.

There is nothing wrong with being proud of what you earn. However, this is clearly not the mentality you need to have if you want to be a member of the Bitcoin Club.

To be a member of the Bitcoin Club, you need to embrace its first essential rule, and apply it no matter what:

You must never reveal what you own in Bitcoin to anyone.

Being a true Bitcoiner requires humility to be willing to learn more and more about Bitcoin and money in general. The humility you develop will cause you to be discreet about what you own in Bitcoin.

Never revealing to anyone what you own in Bitcoin is also a matter of security.

From the moment you reveal what you own in Bitcoin, you can jeopardize your own security. Bitcoin price is set to rise sharply in the years to come. So it will be tempting for ill-intentioned people trying to steal your BTC.

It would be a shame if you were to miss out on the Bitcoin revolution in the future for breaking this commandment.

In the future, if someone asks you what you own in Bitcoin, you will only have to answer that you are forbidden to say. This is part of the Bitcoin Club rules.

In fact, that is my answer to those who frequently ask me this question when I publish stories online. They take it as a joke and ask me again, but my answer is always the same: I never break this commandment. I would advise you to do the same.

III. HODL Bitcoin no matter what

Many people buy Bitcoin without being totally convinced by the Bitcoin revolution. It may seem trivial to you, but in reality, it’s a big problem that puts their money at risk.

These people don’t understand that Bitcoin’s price volatility is a feature, not a bug. You must make this volatility your greatest ally rather than your worst enemy.

So, when you buy Bitcoin, you should be aware that its price can fluctuate significantly up and down. For upward fluctuations, you will need to be able to manage them more easily. On the other hand, you should be prepared to control your emotions when the Bitcoin price drops sharply.

This happened in March 2020 during the liquidity crisis I mentioned earlier. In a few hours, the Bitcoin price went from $8K to less than $4K. Many panicked and sold their BTC at a loss.

At that time, I was talking about the sale season in the Bitcoin world. This allowed all Bitcoiners to accumulate even more BTC. It was a perfect opportunity. But to do that, you have to have complete confidence in Bitcoin. To gain this confidence, there is no secret: you must deepen your knowledge of Bitcoin.

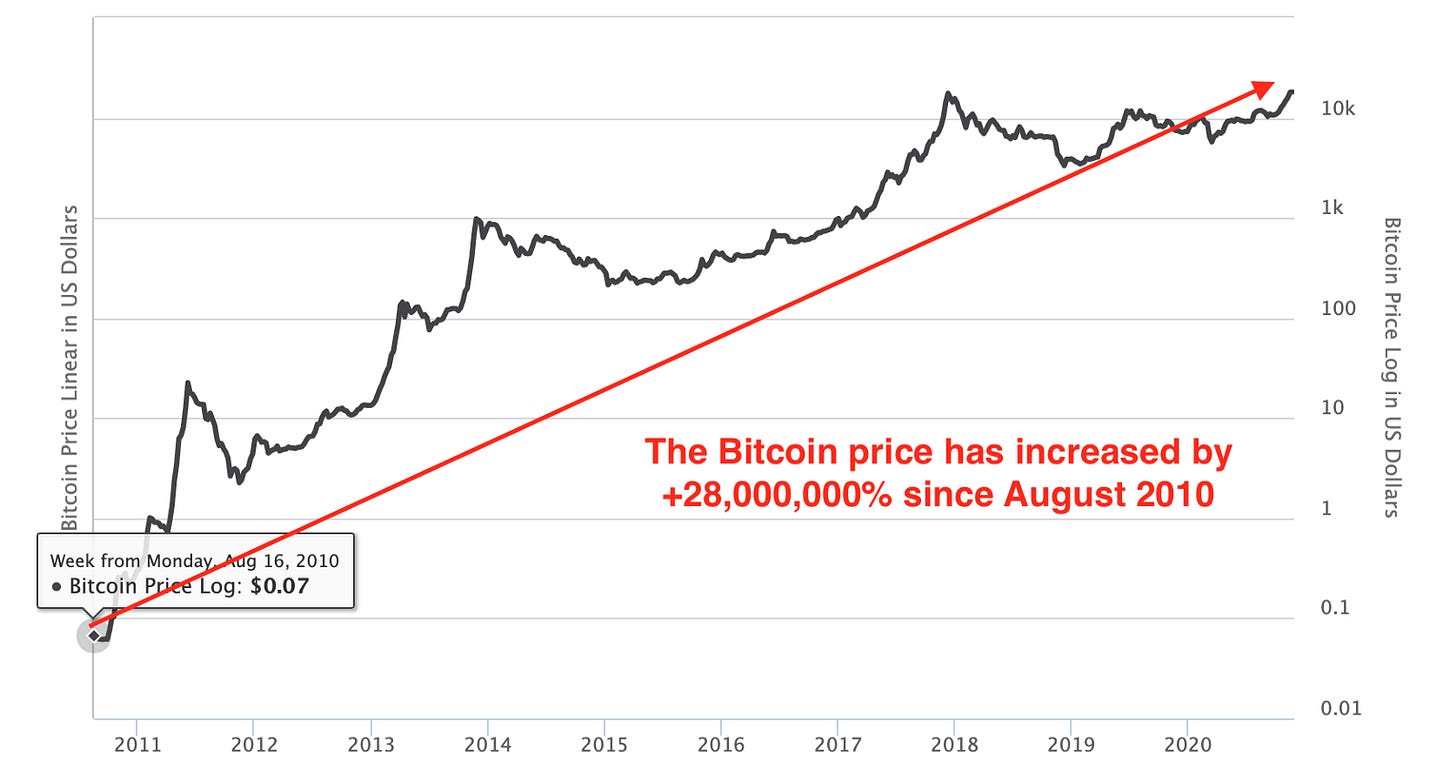

Since the Bitcoin price fell in March 2020, the Bitcoin price has increased by +400%.

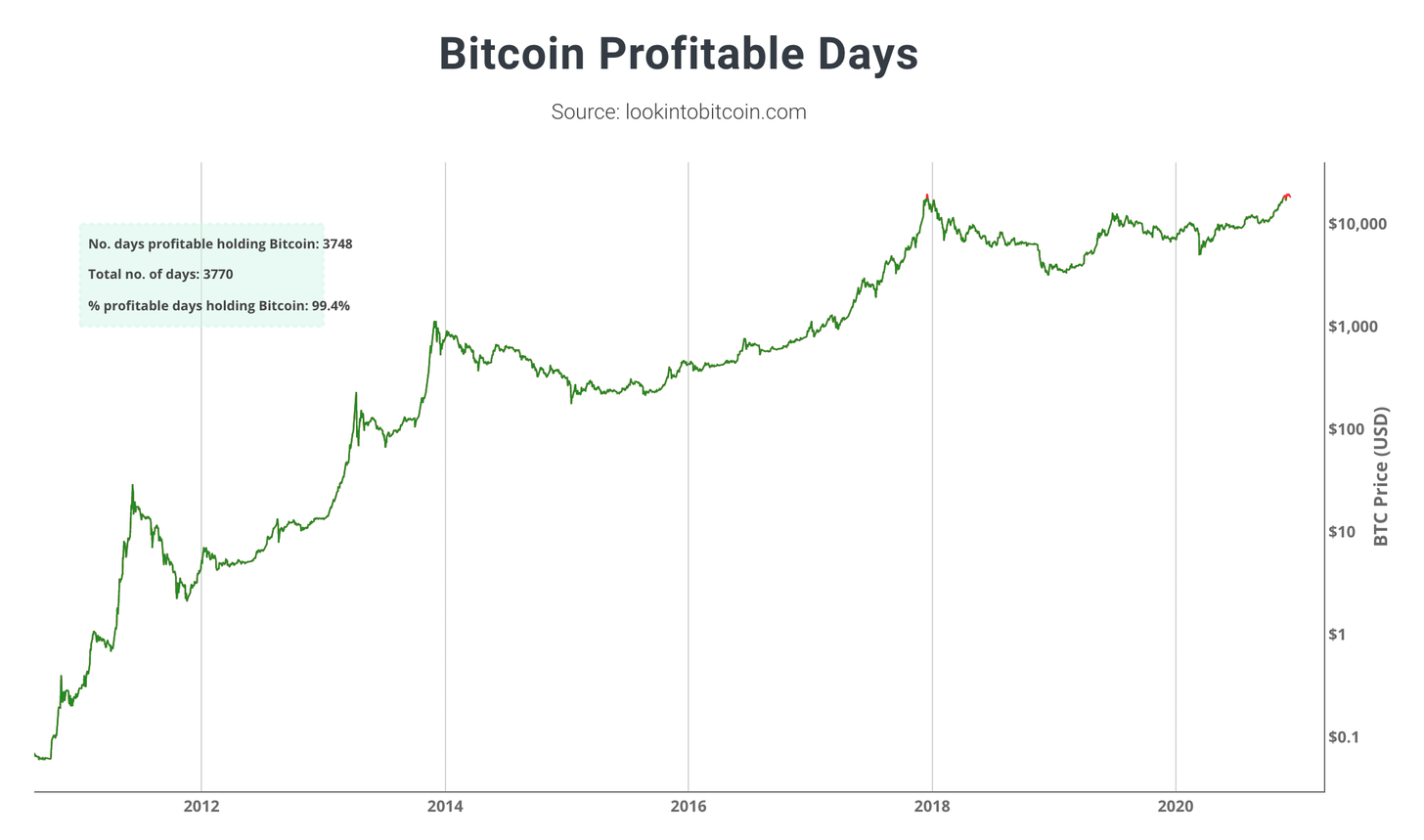

With the current price of Bitcoin between $18K and $19K, HODLing Bitcoin has been a profitable strategy more than 99.6% of the time:

This should make you feel confident that to fully enjoy the Bitcoin revolution, you need to HODL Bitcoin no matter what. Don’t make the mistake of playing the trader, when trading is an activity in its own right that requires specific skills that a majority of people don’t possess.

The best strategy with Bitcoin is also the simplest:

- Buy Bitcoin automatically with a Dollar-Cost Averaging (DCA) approach. Many applications exist for this.

- Program the automatic sending of these Bitcoins to your hardware wallet using one of the applications you will buy.

- HODL Bitcoin no matter what.

- Iterate from step 1.

No need to look for complex strategies to take full advantage of Bitcoin. Simply apply the KISS principle.

IV. Only Bitcoin matters

Bitcoin is a true monetary revolution aimed at creating a better world for as many people as possible in the future. Bitcoin is the money of the people supported by the people.

The electronic money created by Satoshi Nakamoto is the hardest money in the world.

The consequences of a currency like Bitcoin are countless. One point too often overlooked with Bitcoin is that it promotes freedom by allowing millions of people to protect their wealth in a way that is resistant to censorship.

In countries under authoritarian or emerging regimes, Bitcoin is already a Plan A. If you have any doubts, just look at what is already happening in Nigeria, Venezuela, Iran, Lebanon, or Argentina. Bitcoin is already helping millions of people daily.

Bitcoin is a unique invention that differs from the cryptocurrencies that were created later, not in terms of technology, but rather in terms of monetary attributes. The monetary attributes of Bitcoin are unique.

Some will try to make you believe that their cryptocurrency has better technology than Bitcoin. They will tell you that their cryptocurrency can handle more TPS (Transactions per Second). However, they will fail to tell you that this is at the expense of decentralization which is an incredible advantage of Bitcoin.

Don’t be blinded by the empty rhetoric of the founders or supporters of these cryptocurrency projects.

In the long run, only Bitcoin really matters. Moreover, we will stop giving too much importance to these cryptocurrencies by showing that Bitcoin is special. There is Bitcoin and there are cryptocurrencies. Everybody gets it sooner or later.

Some later than others, which will have cost them a lot of time, and even worse, a lot of money often.

V. Your seed is your key

The first of the Ten Commandments of Bitcoin is to always have the private keys associated with your Bitcoins in your possession. Under these conditions, you should not leave your Bitcoins on trading platforms longer than necessary.

A good way to store your Bitcoins is to send them on a hardware wallet. Your wallet will initially generate a seed phrase and ask you to write it down on paper.

A seed phrase, also called a backup seed phrase, is a list of words that stores all the information you need to retrieve access to your BTC stored on the Bitcoin Blockchain. A seed phrase with 24 words is now the standard, as it provides better security.

So you absolutely need to secure your seed phrase because your seed is your key.

If one day you lose your hardware wallet or it doesn’t work anymore, your seed will be your life insurance. You will be able to regain access to your Bitcoins thanks to it. It also means that anyone who manages to access your seed phrase will be able to take all your Bitcoins from you.

Store it in a safe place, but not in a file on your computer or smartphone. Paper is a better solution, but it can deteriorate over time. The solution is to use a metal backup. Several companies offer perfect products for this.

It costs more than a piece of paper but ensuring the security of your Bitcoins is well worth spending a few dozen dollars.

The last solution is to memorize your seed phrase.

VI. If it looks like a scam, It is a scam

Bitcoin is more than just a financial investment. However, its performance since its inception has fueled the greed of hundreds of thousands of people. In the future, it will grow to hundreds of millions of people.

It is worth mentioning that the Bitcoin price has shown a performance of +28,000,000% since 2010. Bitcoin has been the best performing asset of the 2010s, transforming $1 invested in 2010 into $90K at the end of 2019.

For the next decade, Bitcoin should still be the best performing asset. The Winklevoss twins see a 25x gain from here for the Bitcoin price. Currently, the Bitcoin price is at $18.5K.

Their reasoning is based on more than solid assumptions:

- The law of supply and demand.

- The gold market cap.

- The endless inflation of the U.S. dollar.

I often say that the number one enemy in the Bitcoin world is greed.

Some people only think about money and therefore fall into this trap. Out of greed, but also out of gullibility, these people end up believing all the promises that some people make to earn more Bitcoin.

A scam as old as the Internet was used again in the summer of 2020 on Twitter by hackers. They took control of celebrity accounts by sending out tweets basically saying that if you sent them Bitcoin, they would then send you back double the amount of Bitcoin.

Unfortunately, some people have still fallen into the trap.

So this command is there to remind you of something very important: if it looks like a scam from near or far, it is a scam. If it looks too good to be true, it is a scam. Anything that promises to win Bitcoin without doing anything is a scam.

Bitcoin is the hardest money in the world. No one will give you Bitcoins against nothing in 2020. Understand this, and avoid being tricked. If you want to get Bitcoin without any initial investment, offer your services by asking to be paid in BTC.

VII. Check addresses several times

Transactions on the Bitcoin network occur between the address of a sender and the address of a recipient. An address on the Bitcoin network is an alphanumeric identifier of 26 to 35 characters.

An address on the Bitcoin network should be considered as an invoice that can be generated free of charge. There are three types of address formats currently in use:

- P2PKH that starts with a 1.

- P2SH that starts with a 3.

- Bech32 beginning with bc1. Bech32 is a bitcoin address that is fully compatible with SegWit.

When you wish to receive Bitcoin, you will create an address on the Bitcoin network that you will send to your contact. If you wish to send Bitcoin to someone, you will need to ask your contact to send you the address they have created on the Bitcoin network.

If a transaction is made on the Bitcoin network with the wrong address, you risk losing the BTC transmitted during that transaction.

Given the valuable nature of Bitcoin, it would be a shame to lose money for a character input error. This command is there to remind you that you have to check each address of a transaction several times.

Not once, not twice, not three times, but at least four times. This will give you additional guarantees that your transaction will go through the Bitcoin network correctly.

VIII. Buy BTC with money you can afford to lose

In the world of traditional finance, there is one golden rule:

Never Invest Money That You Can’t Afford To Lose.

This rule also applies to the Bitcoin world. You should only buy Bitcoin with money you can afford to lose.

Don’t put yourself in an uncomfortable financial position to buy even more Bitcoins. You could be trapped afterward into making bad choices. To be able to sustain the Bitcoin revolution, in the long run, you need to be smart with your Bitcoin buying strategy.

A good solution is to smooth out your costs by adopting a Dollar Cost Averaging strategy as I told you at commandment III.

This means buying Bitcoin regularly, month after month, for example.

IX. Make your own decisions

When you enter a new field, you will quickly be tempted to follow the most well-known influencers in that field. This is not a bad thing as long as you remain aware of one essential reality :

Influencers, and other experts, give their opinions, but in the end, it is up to you to make your own investment decisions.

In the Bitcoin world, you will notice that a lot of people share their opinions on social networks or forums. I, myself, share my opinions on Bitcoin with you.

Nevertheless, I always take care to tell you that it is not investment advice that I am giving you, but simply my opinion. My goal is to help you educate yourself properly about Bitcoin, money, and economics.

With what I share with you, you will then be able to make your own decisions in a more informed manner. You will therefore maximize your chances of making the best choices for you and your future.

As such, you should keep in mind the following proverb:

“The counselors are not payers.”

People who pretend to give you investment advice without telling you that it is only their personal opinions are not the ones who will risk losing everything if they make a mistake.

This should alert you to the need to make your own investment decisions.

At the end of the day, you will always be alone with your choices. Take as much information as you can, think about your personal strategy, and then act according to your convictions.

This way, you will not fall into the trap of those who blindly follow the advice of Bitcoin’s influencers.

X. Use Bitcoin divisibility to accumulate more

Many people think that the current Bitcoin price is too expensive for them to buy it. The Bitcoin price is indeed beyond $18K at the time of writing.

These people probably don’t know that Bitcoin has an incredible advantage over gold: Bitcoin is divisible up to eight digits after the decimal point.

The smallest unit of Bitcoin is called the Satoshi. We have the following equivalences:

1 BTC = 100,000,000 Satoshis

1 Satoshi = 0.00000001 BTC

Born in mid-2019, the #StackSats movement is there to remind everyone of the importance of accumulating as many Satoshis as possible. Each Satoshi accumulated will make a fundamental difference in the future.

You must use the divisibility of Bitcoin to your advantage. The race to own 1 entire BTC may seem impossible if you only think about buying one in its entirety. If you are patient and buy small amounts of BTC for $50 or $100 regularly, you will eventually reach your goal sooner or later.

Besides, I would advise you to make the volatility of Bitcoin your greatest ally rather than your worst enemy. When Bitcoin price undergoes strong corrections like the one experienced in March 2020 for example, you should take advantage of it to accumulate more BTC.

All this can only be done if you have total confidence in Bitcoin.

Conclusion

The bull rally that the Bitcoin price has just experienced at the end of this year 2020 is nothing compared to what awaits us in 2021. A much more phenomenal Bull Run is expected, which will see hundreds of thousands of retail investors flocking in droves.

To ensure that this Bull Run does not end as badly as it did at the end of 2017, it seems essential to remind new entrants of some basic principles. The Ten Commandments of Bitcoin that I have just detailed will enable new entrants to this world to take full advantage of Bitcoin in complete security.

Provided, of course, that the Ten Commandments of Bitcoin are applied to the letter.